Capitalization Table

After fundraising rounds, company ownership may become complicated. Our Cap Table Automator and Infographics aim to assist you in understanding and creating your Cap Table.

After fundraising rounds, company ownership may become complicated. Our Cap Table Automator and Infographics aim to assist you in understanding and creating your Cap Table.

A Cap Table shows the equity ownership of your company. It is important for overseeing legal obligations arising from securities, monitoring shareholding structure, and making informed business decisions.

Our Cap Table Automator supports up to 110 shareholders in total, across 12 shareholder categories, with step-by-step assistance and terms explanations

Our Automator generates 3 tailor-made tables based on your company ownership and fundraising rounds:

1. Company Ownership

2. Future Shares and Vesting Schedule

3. Valuation after Fundraising Rounds

This deliverable constitutes student research as part of coursework for LITE Lab@HKU and nothing contained should be construed nor relied upon as legal advice by HKU nor its students nor instructors.

How can Cap Table help you in your business?

How can a Cap Table guard you against unnecessary legal liabilities?

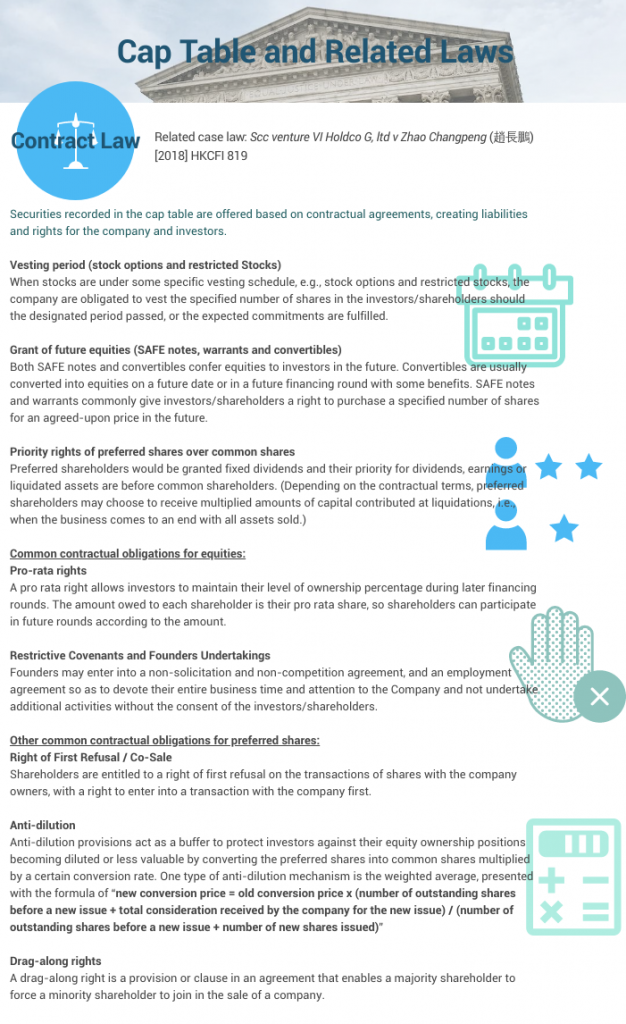

A recent Hong Kong case, Scc venture VI Holdco G, ltd v Zhao Changpeng (趙長鵬) [2018] HKCFI 819, concerns the injunction restraining the company founder from entering into any agreement other than the plaintiff potential investor. In the judgement, the cap table was cited as circumstantial evidence to ascertain the status of the plaintiff as the first external investor. It entails the legal implications arising from cap tables. The following infographic aims to shed light on what laws are reflected and implied in cap tables in more details.

Reference:

1. Kenton, W. (2020), Anti-Dilution Provision: Definition, How It Works, Types, Formula, Investopedia < https://www.investopedia.com/terms/a/anti-dilutionprovision.asp>

2. Tarver, E., (2020), What Are Drag-Along Rights? Meaning, Benefits, and Example <https://www.investopedia.com/terms/d/dragalongrights.asp> (2019).

3. Minority shareholders’ rights in Hong Kong, Lorenz & Partners <https://www.lorenz-partners.com/minority-shareholders-rights-in-hong-kong/>

Common share is a widely available kind of security that represents ownership in the company. The kind of securities are usually indicated in the share transfer agreement. It usually comes with 1 vote per share, granting shareholders the right to vote.

Preferred share is a kind of security that represents ownership in the company. The kind of securities are usually indicated in the share transfer agreement. Usually investors of companies would acquire preferred shares.

Depending on the contractual terms, some preferred shares are convertible. In other words, they can be converted to a fixed number of common shares after a certain period of time or on a specific date.

Preferred shareholders would be granted fixed dividends and their priority for dividends, earnings or liquidated assets are before common shareholders.

A stock option gives investors the right to buy a stock at an agreed price and on a future date. An example is the employee stock option plan. The recipients may choose to exercise the right at a future date. Nonetheless, tax-related legal liability arise when the stock options are exercised. For details of the related tax liabilities, please check here.

Restricted stocks can be issued to employees and the grant of the shares is subject to a vesting schedule. The stocks would be vested in the recipients after a certain period of time or after they achieved certain performance milestones

Before vesting, restricted stock units do not confer the right to sell or the right to vote. Yet, they are already valuable based on the underlying shares.

Similar to stock options, restricted stocks may be subject to certain tax duties.

A stock warrant gives the holder the right to purchase a company’s stock at a specific price and on a specific date. It is usually issued by a company to its investors.

SAFE notes

SAFE (or simple agreement for future equity) notes give investors a right to purchase a specified number of shares for an agreed-upon price at some point in the future. Investors can choose whether to exercise the right. The valuation cap of a SAFE is a ceiling i.e. the maximum valuation imposed on the price at which a SAFE will convert to stock ownership in the future.

Convertibles are securities, usually bonds or preferred shares, that can be converted into common stock on a future date (maturity date) or in a future financing round with some discounts or benefits. They are usually issued by companies to investors.

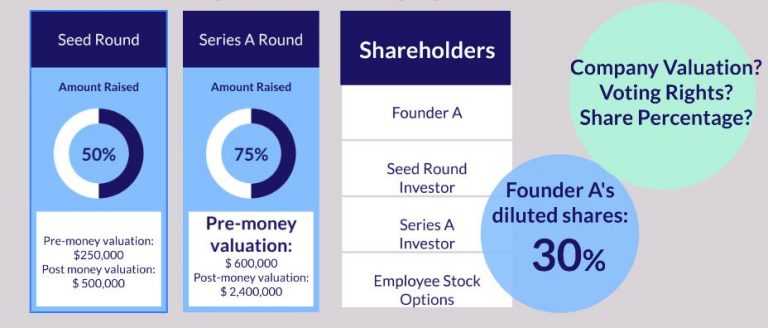

A pre-money valuation refers to the value of a company before it receives investments such as external funding or financing.

Post-money valuation is a company’s estimated worth after financing or capital injections are added to its balance sheet.

The fully diluted shares would be calculated as an expression of the number of outstanding shares that are issued, or can be issued and converted. They include convertible notes and shares subject to a vesting schedule.

Anti-dilution calculation that targets to protect investors’ share values from being diluted. The mechanism of weighted average is regarded as more popular and fairer in balancing the interests between founders and investors. The formula for the calculation is “new conversion price = old conversion price x (number of outstanding shares before a new issue + total consideration received by the company for the new issue) / (number of outstanding shares before a new issue + number of new shares issued)”.

Reference:

1. Kenton, W. (2020), Anti-Dilution Provision: Definition, How It Works, Types, Formula, Investopedia < https://www.investopedia.com/terms/a/anti-dilutionprovision.asp>Notice and Disclaimer

This deliverable constitutes student research as part of coursework for LITE Lab@HKU and nothing contained should be construed nor relied upon as legal advice by HKU nor its students nor instructors.