CRYPTO WALLETS

Crypto Wallets are virtual wallets that help store your private keys and helps ensure your crypto is safe and accessible. Crypto Wallets can also be used to send, receive and spend cryptocurrencies.

DISCLAIMER: This deliverable constitutes student research as part of coursework for LITE Lab@HKU and nothing contained should be construed nor relied upon as legal advice by HKU nor its students nor instructors.

Hot Wallets

One of the first steps before accepting cryptocurrency for your business is setting up a crypto wallet. There are two main types of wallets: hot and cold. Hot wallets refer to wallets that require an internet connection.

Desktop Wallets

Desktop wallets allow holders to keep their private keys on their computer’s hard drive. This allows holders to conduct transactions securely on their computers. Typically, using a desktop wallet means that no third parties have access or control over the holder’s wallet or private keys. However, storing cryptocurrency on a desktop makes the wallet vulnerable to malware or computer viruses. People other than the holder with access to the desktop may also gain access to the wallet.

Examples of desktop wallets are:

- Bitpay

- Exodus

- Electrum

Web Wallets

Web wallets utilize third-party exchanges, websites, or other digital custodians to store cryptocurrencies. Web wallets are generally the easiest to use and support a wide variety of transactions. However, using web wallets also requires third parties to secure private keys, and if the website is compromised, holders may lose all their cryptocurrency. Like desktop wallets, web wallets also risk malware and computer viruses.

Examples of Web wallets are:

- Coinbase

- Metamask

- Phantom

Mobile Wallets

Mobile wallets store cryptocurrencies in phones. This allows holders to have mobile access to their cryptocurrencies, and holders are not tied down to physical locations compared to desktop wallets. The most considerable risk to mobile wallets is the possibility of losing the device that hosts the wallet. There are very few ways to recover the lost assets if the device is compromised or stolen.

Examples of Mobile wallets are:

- Bitpay

- Mew

Cold Wallets

Paperware Wallets

Paper wallets are exactly what it sounds like: a piece of paper that contains private keys. Using a paper wallet means that it is impossible to hack and that holds have complete control over their wallet. However, paper is misplaced or destroyed; once it is gone, it cannot be recovered. It also requires more effort to keep diligently compared to hot wallets.

Examples of Paperware Wallets are:

- WalletGenerator.Net

- Bicoinpaperwallet.Net

Hardware Wallets

Hardware wallets are a more advanced type of wallet that uses a holder’s private key to sign in, verifying the transaction on the blockchain. The wallet itself is usually a piece of metal that hosts the cryptocurrency. However, hardware wallets tend to cost much more than the aforementioned ones, which are usually free or have meagre costs. Hardware wallets also have a higher knowledge gap that may be difficult for first-time users.

Examples of Hardware Wallets are:

- Ledger Nano S Plus

- Trezor Model One

How to incorporate Crypto to Retail Corporations

Step 1

After setting up and creating your wallet. The next step to accepting cryptocurrency for your online store is choosing a platform. For this example, we will be using Shopify. Shopify can be reached at http://shopify.com/. After creating your account, you will be directed to create your first online store.

Step 2

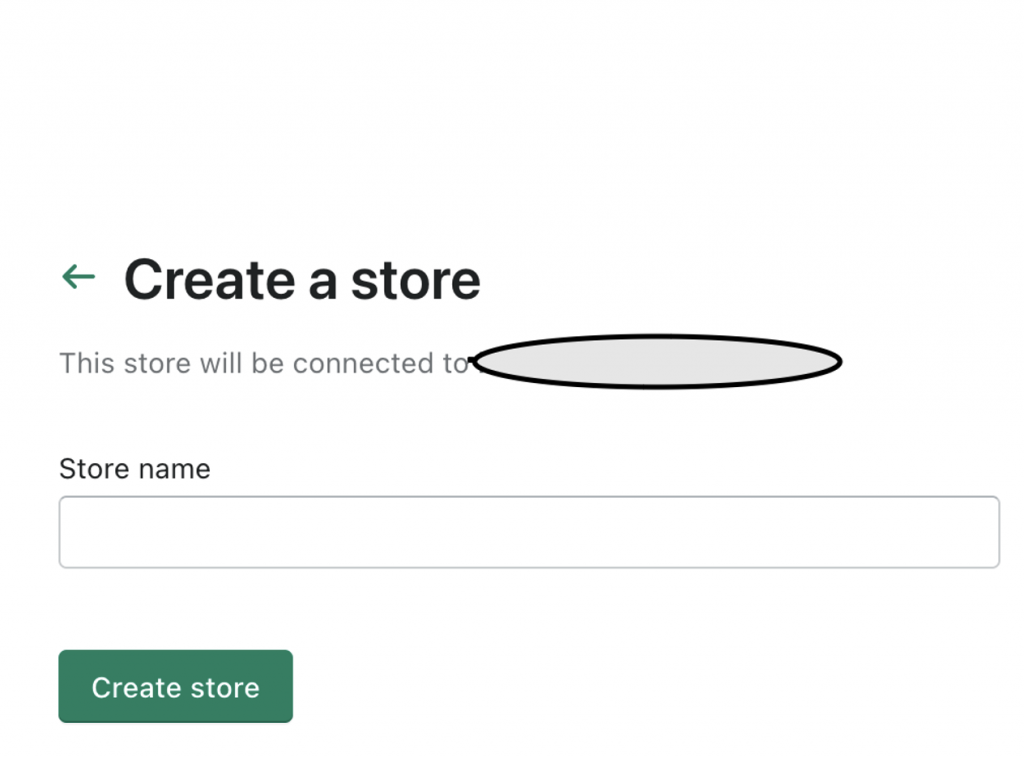

The store will be connected to your email, and you will be directed to creating a store name.

Step 3

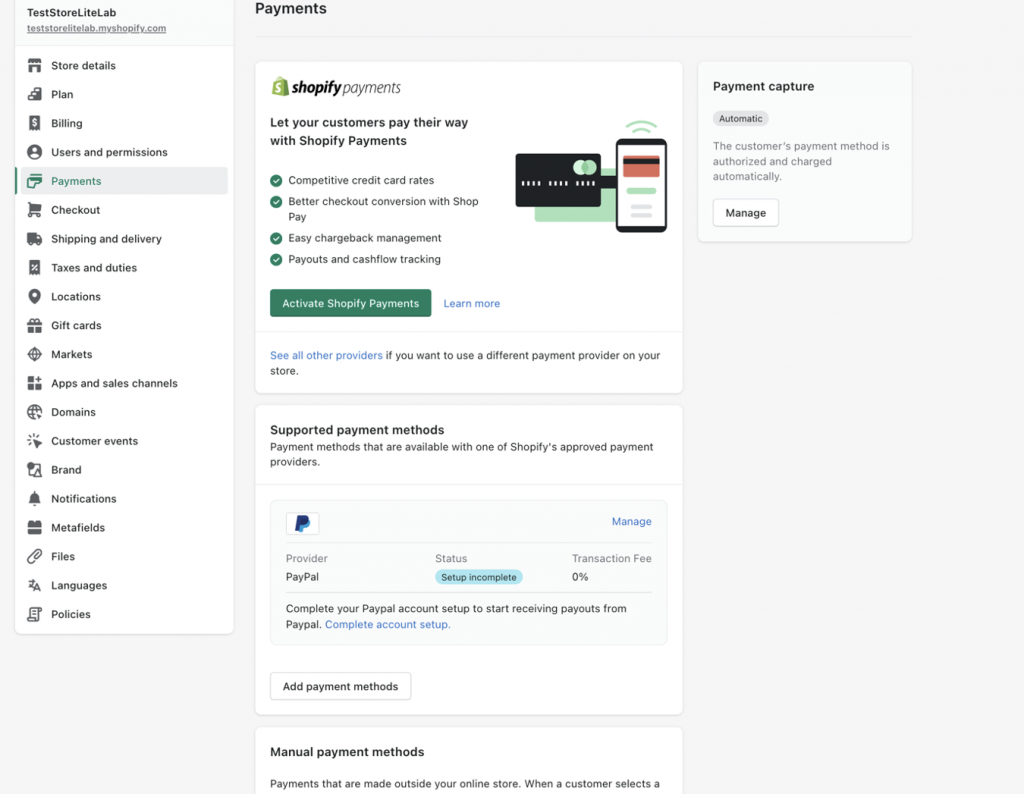

After creating a store name and proceeding with the initial set up procedures you can search up “payment” in the search bar. You will then select add payment methods.

Step 4

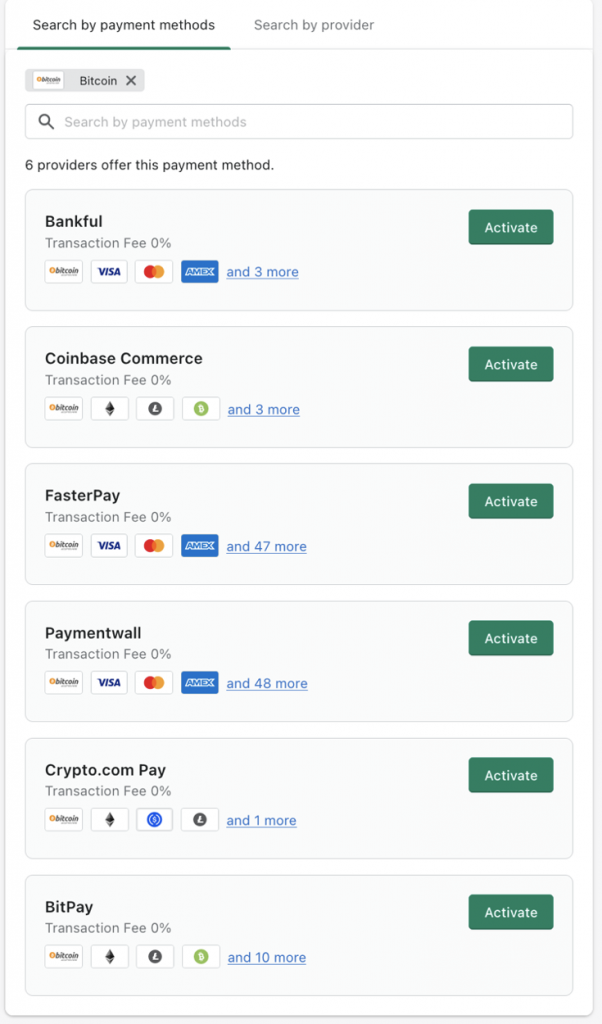

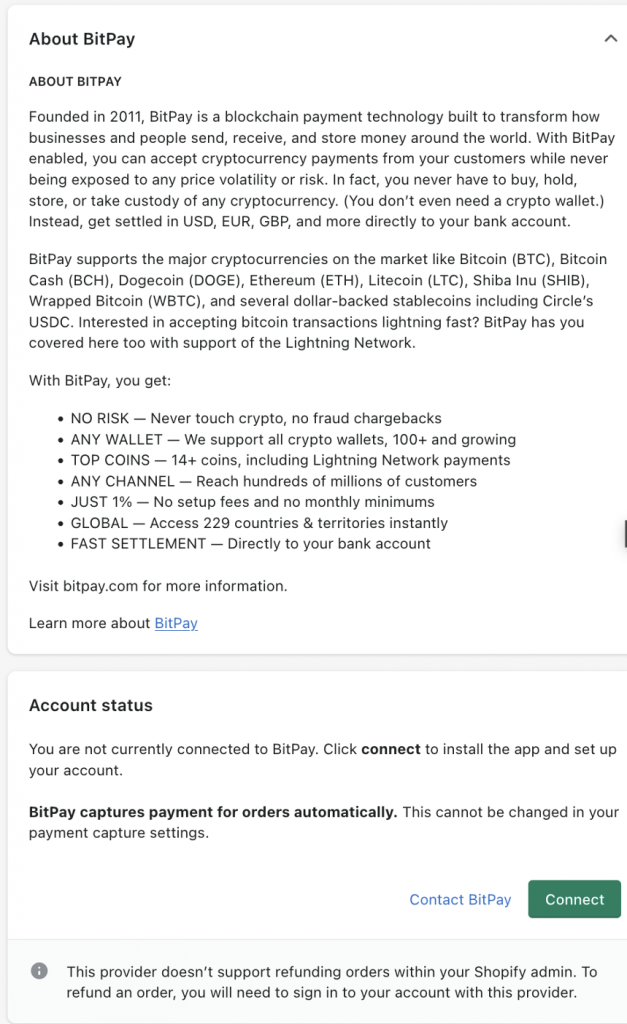

You may then choose the type of cryptocurrency you would like to receive from your store. This example uses Bitcoin. As you can see see, Shopify accept several wallets/exchanges including Bankful, Coinbase, FasterPay, Paymentwall, Crypto.com, and Bitpay.

Step 5

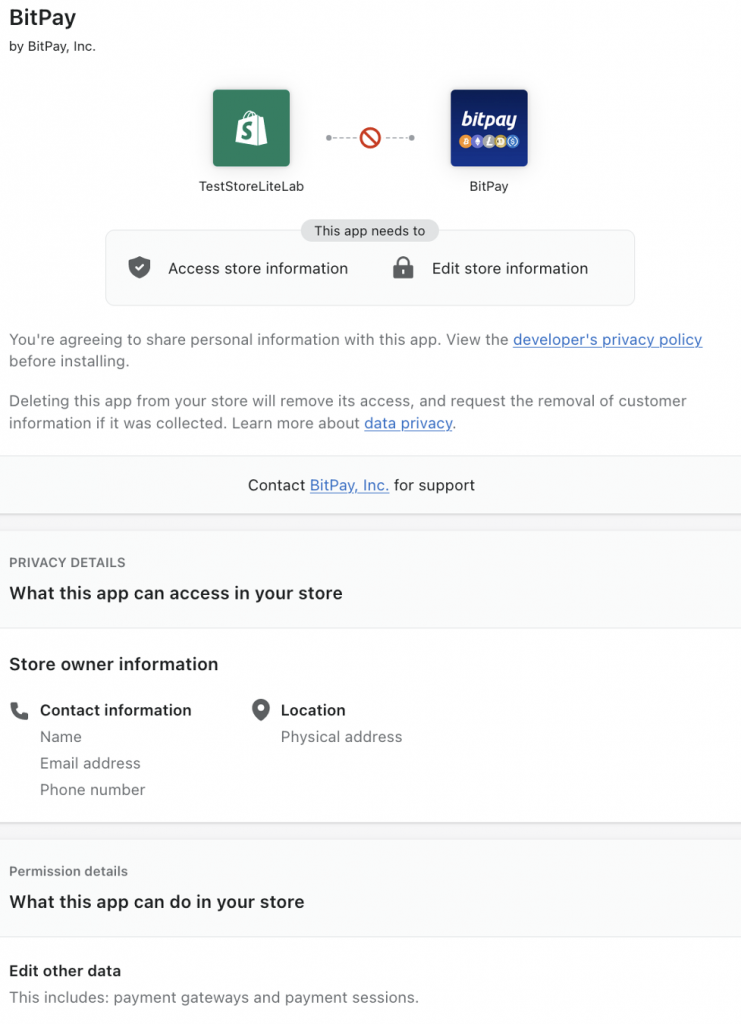

After choosing your wallet/exchange, you will be directed to connect your account.

Step 6

If you completed all of the information, the store should be successful set up and you can now receive crypto payments for your orders.

© 2022 All Rights Reserved.